Many people feel uncertain about how much to tip a valet when using parking services. Tipping habits vary widely across regions and situations, causing confusion. Knowing the customary tip amount and proper etiquette helps ensure a positive parking experience. This guide explains how much to tip valet attendants based on service quality and location. You …

Gain clarity and confidence with financial insights designed to guide your journey. Make informed decisions and take control of your financial future with our expert resources and practical financial tips.

Secure

Your financial security is our priority. We provide trusted advice to help you make decisions safeguarding your financial future

Swift

Access practical insights designed to make positive financial changes swiftly so that you can see results without delay

Dependable

Our resources are here for you—dependable, consistent guidance to support your financial goals every step of the way

Efficient

Our insights make it easy to take action on your financial journey, providing efficient solutions that fit your lifestyle and goals

Maximize Your Spending

Maximize Your Spending

Secure & Simple Transactions

Secure & Simple Transactions

Smart Currency Choices

Smart Currency Choices

Our expert team is here to provide valuable financial tips and guide you every step of the way. Reach out for customized solutions that fit your unique financial journey.

Connect with

Us

1

Personalized Plan

2

Step-by-Step Guidance

3

Financial Freedom

4

Safeguarding Your Hard-Earned Money, Ensuring Peace of Mind

Protecting your finances is essential for long-term stability. Learn how to manage your money wisely, avoid common pitfalls, and make informed financial decisions. With the right financial tips, you can build a secure future and gain peace of mind.

Here, you can find all the information you need to reach out to our online bank. Whether you have questions about your account, need assistance with our services, or want to provide feedback, we’re here to help.

What is online banking?

Online banking, also known as internet banking, is a digital platform provided by banks and financial institutions that allows customers to perform various financial transactions and manage their accounts over the internet.

How do I sign up for online banking?

To sign up for online banking, contact your bank or visit our website. Typically, you will need to provide your account information and create a username and password.

Is online banking safe?

Yes, online banking is generally safe if you follow security best practices. This includes using strong, unique passwords, enabling two-factor authentication, and being cautious about phishing emails or websites.

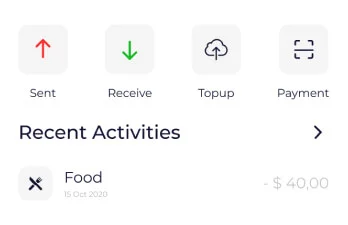

What transactions can I perform with online banking?

You can perform a wide range of transactions, including checking your account balance, transferring money between accounts, paying bills, setting up automatic payments, and viewing transaction history.

Resources to Keep You Informed

Many individuals face challenges when trying to build or rebuild their credit. Traditional credit cards often require a good credit score, making it difficult for those with limited or poor credit histories to qualify. This lack of access can hinder financial growth and opportunities. The First Latitude Credit Card offers a solution by providing a …

Many consumers face challenges when trying to build or rebuild their credit due to limited credit card options. Numerous credit cards require excellent credit, making it difficult to qualify. Additionally, some cards have high fees and confusing terms that hinder credit improvement efforts. The Fortiva credit card offers a credit-builder option aimed at individuals with …